Assumptions and Validations

Introduction:

Assumptions were ideated as a team, and a long list compiled. The larger assumption list was cut down to a list of 7 core assumptions by voting as a team based on the Impact and Uncertainty score. The results of the final 7 can be viewed on Figure 1

In order to guarantee we hit enough types of assumption, they were categorised into: Market, Customer, User, Team, Access, Features, Technology, Financial*

*Financial Assumptions are covered in Business Model and CAC page

Competitor Adoption Reasons

Company Profile is Correct

User Profile is Correct

DFM is Target DFMA Issue

There is an Expertise Gap

Desired Analysis Level is Correct

We can Access DFM Expertise

Contents:

Assumptions and Experiment Plan

Competitor Adoption Reasons

Assumptions

There is an Expertise Gap

Desired Analysis Level is Feasible

DFM reduces cost

DFM is Target DFMA Issue

Company Profile is Correct

User Profile is Correct

Interviews

1.a Customer and

User Interviews

2.a Customer Interviews

3.a User Interviews

4.a Customer and User Interviews

5.a Customer Interviews

Other

1.f Survey

4.f DFMA Survey test

5.g User Part Test

6.g Customer and User Part Test

Secondary Research

1.b Sentiment Analysis

2.c Route to Market Research

4.b Sentiment Analysis

5.d DFM Course Research

6.d DFM Course Research

7.e Manufacture Study

Competitor Adoption Reasons

“If it’s expensive and doesn’t give me the depth of analysis I need it’s hard to justify”

Jake Moll, Mechanical Engineer at Innovia Technology

Anarug Chaudhary, Senior Engineer at Denso International

“High skills required. Not easy to learn for beginners. High cost.”

Callum Reynolds, Mechanical Engineer at Sagentia

“Most people in the team had never heard of them”

Customers are dissatisfied with and therefore not adopting competing products primarily because:

· They don't show the necessary time savings

· They are expensive

· They don’t satisfy the required level of analysis

· They have not heard of them

100%

of quotes mentioned one of the above concepts

1.a Customer and User Interviews

Input:

Interviews with 13 users and 13 customers:

Results:

Passed - 100% mentioned one of the concepts

Failed - All concepts were mentioned in at least 20% of quotes other than “they are expensive”, which was not mentioned

Users are dissatisfied with and therefore not adopting the competition primarily due to:

· A lack of integration into the engineer's workflow

· Effort to input excessive parameters

· They have a poor UI/UX

· A lack of real-time design feedback

· Steep learning curve to use the software

52%

of quotes mentioned one of the above concepts

1.b Sentiment Analysis

Input:

Quotes from 56 negative online customer reviews / complaints

Results:

Passed - 52% mentioned one of the concepts

Failed - All concepts are mentioned in at least 10% of quotes except “They don't show the necessary time savings” wasn’t mentioned

Minimal number of reviews suggests a lack of adoption

Company Profile is Correct

“I can see a programme like that being incredibly beneficial”

Calum Reynolds, Mechanical Engineer at Sagentia

Lionel Gousset, General Manager at CMR surgical

“There’s clearly room for a more robust, automated solution that gives precise, actionable

insights right when you need them.”

“If you manage to develop a solution ... would be useful, yes”

Dave Fustino, Product Development Lead at ETHO

The customers are those with software purchasing power in hardware engineering firms (typically business owners / managers), and we can access them in sufficient quantity. Hardware centred startups are a disproportionately good target for our route-to-market due to:

Utilisation of CNC machining & injection moulding

Typical Products are suitably sized with reasonable xo

Cost sensitivity & Quality constraints/requirements

Input:

Strict 1 hour search for 20 possible start-ups that match above criteria on google / chatgpt.

Results:

Passed - 25 start-ups were found that match the criteria

2.c Sentiment Analysis

52%

startups found in an hour that match the criteria

Input:

Interviews with 13 customers with explanation of effio product offering, whilst walking through them effio UI

Results:

Passed - 100% of customers asked had positive feedback

Interviewed 13 customers, indicating good access

1.a Customer and User Interviews

100%

shared positive feedback on the proposed tool

13

customer interviews, indicating good accessibility

User Profile is Correct

Kartal Cagatay, System Engineer at Olser Diagnostics

“If there’s a tool that from the CAD stage saves you from reworking the CAD, that would be quite nice. If it worked, it would be a multi‑million successful business.”

"If you can introduce a tool where even from the beginning engineers don't have to spend extra effort thinking about manufacturability... it adds real value."

Rizwan Qureshi, Mechanical Engineer at CMR surgical

The target users are mechanical design engineers in hardware engineering firms, and we can access them in sufficient quantity.

Input:

Interviews with 13 users with explanation of effio product offering, whilst walking through them effio UI

Results:

Passed - 85% of users had positive feedback

13 interviews with users conducted, indicating they can be accessed on mass

3.a User Interviews

100%

showed positive feedback to the proposed tool

13

user interviews, indicating good accessibility

DFM is Target DFMA Issue

"Manufacturability ... trips us up most, so that’s where we focus our energy."

Hania Mohiuddin, Founder of Mars Jets

James Adamson, Manufacturing Engineer at APPH

“Assembly rarely gives us big headaches. It’s really about manufacturability”

“I would say DFM is generally more important”

Design for Manufacturing or Design for Assembly?:

r/MechanicalEngineering

Design for Manufacture (DFM) is the most critical Design for Manufacture and Assembly (DFMA) issue (or a necessary prerequisite) that the users and customers want to see developed.

Input:

Interviews with 13 users and 13 customers, and 4 manufacturers

Results:

Passed - 67% of interviewees stated that they prioritised DFM over DFA

Users were more likely than customers to prioritise DFA over DFM, but were still more in favour of DFM

4.a Customer and User Interviews

67%

prioritised DFM as most critical DFMA issue

Input:

15 DFMA resources gathered using online platforms e.g. Reddit & Youtube

Results:

Failed - Of the 15 resources analysed, 7 favoured DFM and 8 favoured DFA

Test likely failed owing to traditional DFMA approaches beginning with DFA. This does necessarily mean DFA is the priority for users and customers

4.b Sentiment Analysis

20%

higher ranking on average DFM tasks

Input:

Asked respondents to rank which of these activities (DFM or DFA) is best to improve their or their teams skills

Results:

Passed:

Users: DFM ranked 14% higher

Customers: DFM ranked 30% higher

4.f DFMA Survey Test

There is an Expertise Gap

“There’s no easy place to pick up that real manufacturing intuition. Instead, you have to live it.”

Matt Stedman, Co-founder at Hard Stuff

Gregory Sale, Mechanical Engineer at PA Consulting

“The intuition, the expertise, the skill is locked up in engineers who spent decades engaging with these problems”

“A lot of the grads and the younger guys who are doing the CAD ... have no idea how it relates to the production line.”

James Adamson, Manufacturing Engineer at CMR Surgical

Ben Thorpe, Design & Manufacturer Manager at Naiad Aqua Systems

They [manufacturers] don’t care about the development up front, so you end up in this no man’s land…they’re just pointing out the obvious to you, you’re making the changes, going back—‘Is this right, can you check my homework?’—and yeah…”

“If you can’t plug that gap internally, you’ll hire it in. If you don’t have the time to upskill or the internal resources, you contract it out. That’s not always great, though, because you risk losing control. So it’s situational.”

Koushiic Durai, Founder at WowFactories

There is a clear gap in Design for Manufacture (DFM) expertise with the user, current methods for bridging the gap (upskilling, diverting internal resources, hiring expertise and contracting), are insufficient, and this is explicitly recognised by the customer.

85%

agreed there is a skills gap

Input:

Strict 2 hour search into as many commercially focused DFM courses as possible as a proxy for users requiring DFM education

Results:

Gathered a list of 16 online / in person courses / tutorials

Mix of 3 day in-person programmes and 3 hour online courses

5.d DFM Course Research

29%

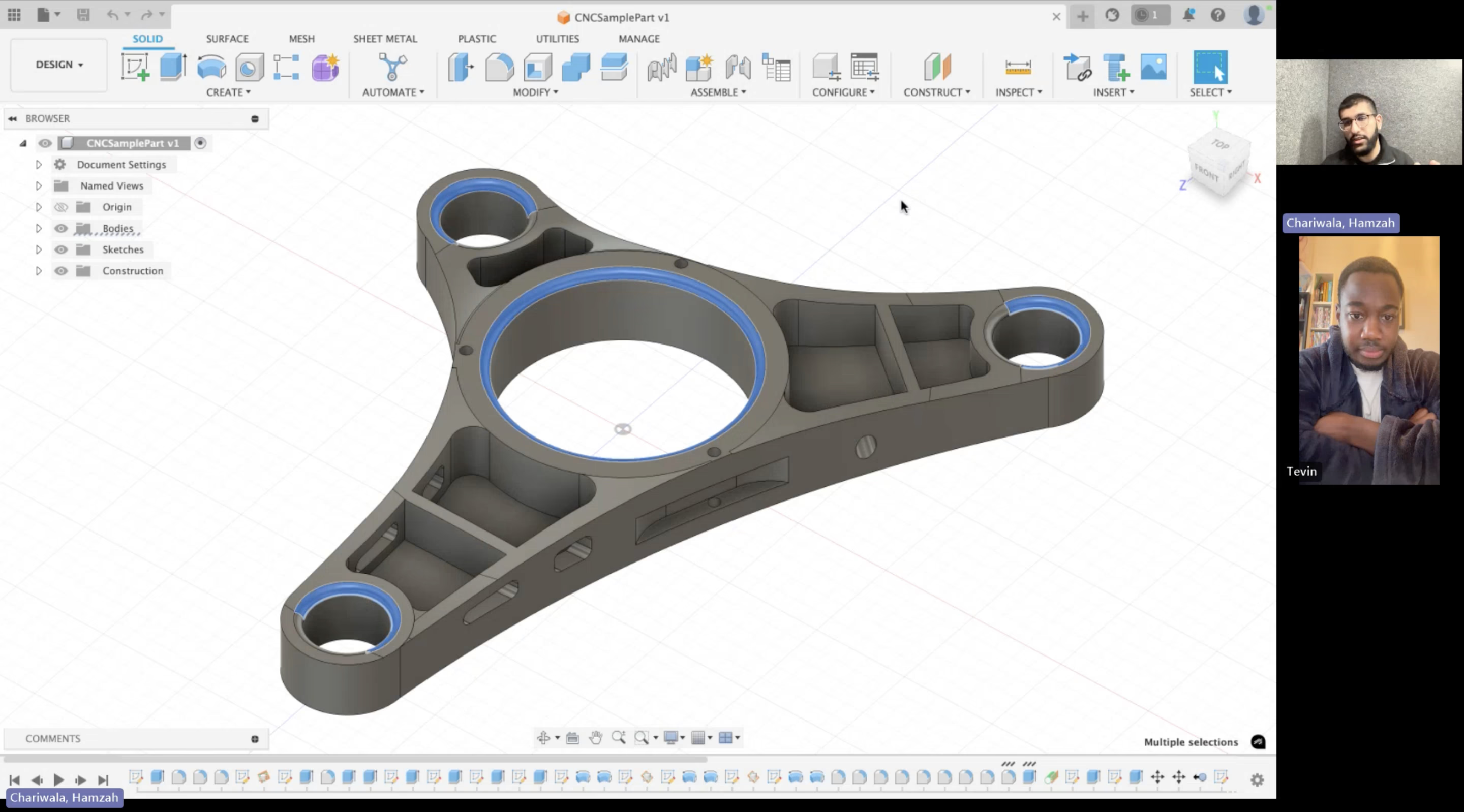

of problematic features were identified by users

Input:

All of the manufacturability issues that users could spot in the sample part

Results:

Passed - Of the 14 problematic features, only 29% were identified on average

Detailed Results - Features and Validation Page

5.g Customer and User Part Test

Input:

Conducted interviews with 13 customers

Results:

Passed - 85% of interviewees agreed that there is an expertise gap

Passed - 73% of interviewees agreed that Current methods are insufficient

5.a Customer and User Interviews

73%

agreed current methods are insufficient

DFM Reduces Cost

The reduction of cost of DFM optimised parts is clear and of significant value to the customer

Input:

Sent part with problematic features to CNC manufacturer and asked to manufacture, on the assumption they will flag manufacturability issues

Results:

Passed - 25% reduction of cost from £326 to £260 through 2 proposed minor manufacturability improvements

3.a User Interviews

25%

reduction of cost from the 2 proposed modifications compared to original part

Interviews

Gathered a list of suitable companies to interview people from, based on the key criteria:

Utilisation of CNC machining & injection moulding

Products have appropriate scale and complexity

Cost sensitivity & Quality constraints/requirements

Used LinkedIn to find potential Customers and Users at each identified company and connected with them. Messaged them to request an interview, with the attached landing page / website.

In addition, contacted adjacent stakeholders, such as manufacturers and accelerator heads.

Role Breakdown of Interviewees

We interviewed 13 users and 13 customers

Manufacturing Engineers

Manufacturers

Accelerator

Heads

Founders

Mechanical / Design Engineers

Senior Engineers

Figure 2: DFM Part Test, Highlighting faces of problematic features

Figure 1: Collage of some of our Interviewees

Figure 3: Collage of some of the companies we have enagaged with

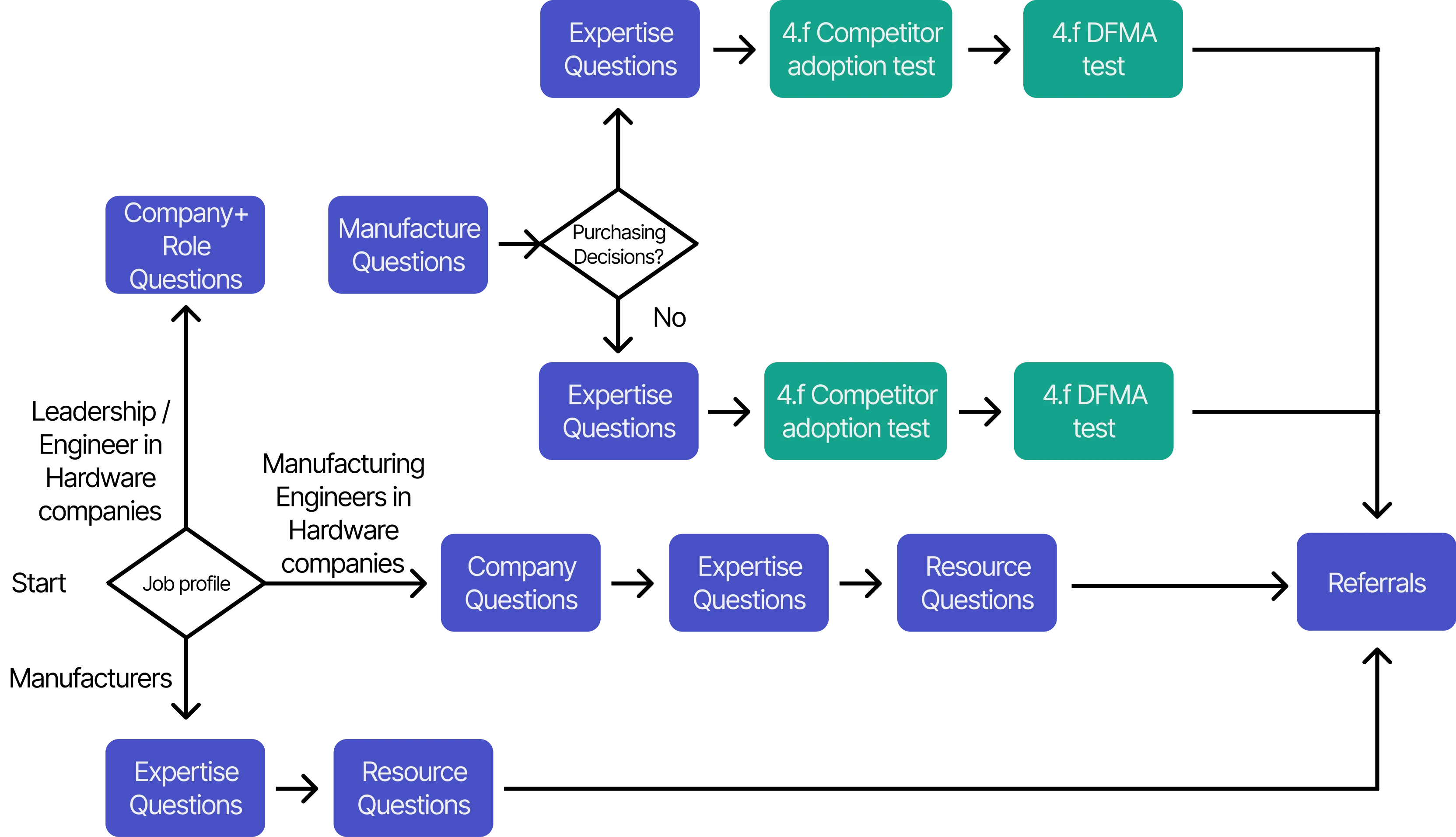

Survey Structure

20 people filled in the survey, enough for good DFMA data, but not enough for good Competitor adopotion data